Feie Calculator Things To Know Before You Buy

The 8-Second Trick For Feie Calculator

Table of ContentsAn Unbiased View of Feie CalculatorThe Basic Principles Of Feie Calculator Feie Calculator Can Be Fun For EveryoneExcitement About Feie CalculatorExamine This Report about Feie CalculatorThe 7-Second Trick For Feie CalculatorSome Of Feie Calculator

If he 'd regularly traveled, he would certainly rather finish Part III, providing the 12-month period he satisfied the Physical Existence Test and his travel history - Foreign Earned Income Exclusion. Action 3: Coverage Foreign Income (Part IV): Mark earned 4,500 per month (54,000 every year). He enters this under "Foreign Earned Income." If his employer-provided real estate, its value is likewise included.Mark calculates the exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his income (54,000 1.10 = $59,400). Because he lived in Germany all year, the percent of time he lived abroad during the tax obligation is 100% and he gets in $59,400 as his FEIE. Lastly, Mark reports overall wages on his Form 1040 and enters the FEIE as an unfavorable amount on Set up 1, Line 8d, minimizing his taxable earnings.

Selecting the FEIE when it's not the very best choice: The FEIE may not be perfect if you have a high unearned revenue, make more than the exemption limitation, or stay in a high-tax nation where the Foreign Tax Credit Score (FTC) might be extra beneficial. The Foreign Tax Obligation Credit Score (FTC) is a tax obligation decrease technique frequently used along with the FEIE.

See This Report about Feie Calculator

expats to counter their united state tax obligation financial obligation with foreign earnings taxes paid on a dollar-for-dollar decrease basis. This indicates that in high-tax nations, the FTC can usually remove U.S. tax obligation financial obligation entirely. The FTC has constraints on eligible taxes and the optimum case quantity: Eligible tax obligations: Only revenue tax obligations (or taxes in lieu of income tax obligations) paid to foreign federal governments are qualified (Digital Nomad).

tax responsibility on your foreign earnings. If the foreign tax obligations you paid exceed this restriction, the excess foreign tax obligation can generally be lugged ahead for as much as 10 years or lugged back one year (via a changed return). Maintaining precise documents of international earnings and tax obligations paid is as a result crucial to computing the appropriate FTC and keeping tax compliance.

expatriates to lower their tax obligation responsibilities. If a United state taxpayer has $250,000 in foreign-earned income, they can exclude up to $130,000 making use of the FEIE (2025 ). The staying $120,000 might after that go through taxes, but the united state taxpayer can potentially use the Foreign Tax obligation Credit history to counter the taxes paid to the foreign nation.

The Buzz on Feie Calculator

He sold his United state home to develop his intent to live abroad completely and used for a Mexican residency visa with his spouse to help fulfill the Bona Fide Residency Examination. Neil points out that buying building abroad can be challenging without initial experiencing the area.

"We'll certainly be beyond that. Even if we return to the United States for physician's visits or organization phone calls, I doubt we'll spend greater than 30 days in the US in any type of offered 12-month duration." Neil stresses the importance of rigorous monitoring of U.S. check outs. "It's something that individuals need to be really diligent concerning," he claims, and encourages expats to be mindful of typical errors, such as overstaying in the united state

Neil takes care to stress to united state tax obligation authorities that "I'm not find here performing any type of service in Illinois. It's just a mailing address." Lewis Chessis is a tax obligation advisor on the Harness system with comprehensive experience aiding U.S. people browse the often-confusing realm of international tax conformity. Among one of the most usual misconceptions amongst united state

Excitement About Feie Calculator

income tax return. "The Foreign Tax obligation Credit history enables individuals functioning in high-tax nations like the UK to counter their united state tax liability by the amount they've currently paid in taxes abroad," states Lewis. This makes certain that deportees are not tired twice on the exact same earnings. Those in low- or no-tax countries, such as the UAE or Singapore, face extra hurdles.

The prospect of lower living costs can be tempting, however it commonly includes compromises that aren't quickly apparent - https://hearthis.at/feiecalcu/set/feie-calculator/. Housing, for instance, can be extra cost effective in some countries, but this can imply jeopardizing on infrastructure, safety and security, or accessibility to trustworthy utilities and services. Economical properties may be situated in areas with inconsistent net, limited public transport, or unreliable health care facilitiesfactors that can substantially influence your daily life

Below are several of the most regularly asked inquiries about the FEIE and other exemptions The Foreign Earned Revenue Exemption (FEIE) enables U.S. taxpayers to leave out up to $130,000 of foreign-earned income from government earnings tax obligation, reducing their united state tax obligation obligation. To qualify for FEIE, you have to satisfy either the Physical Visibility Examination (330 days abroad) or the Bona Fide House Test (prove your main residence in a foreign nation for a whole tax year).

The Physical Existence Examination requires you to be outside the united state for 330 days within a 12-month period. The Physical Presence Test likewise needs U.S. taxpayers to have both an international revenue and an international tax home. A tax home is specified as your prime location for organization or work, no matter your family members's residence. https://www.40billion.com/profile/879494225.

Feie Calculator Can Be Fun For Everyone

An earnings tax treaty in between the U.S. and an additional nation can help stop dual tax. While the Foreign Earned Income Exemption reduces taxed income, a treaty might offer fringe benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a required declare united state residents with over $10,000 in international monetary accounts.

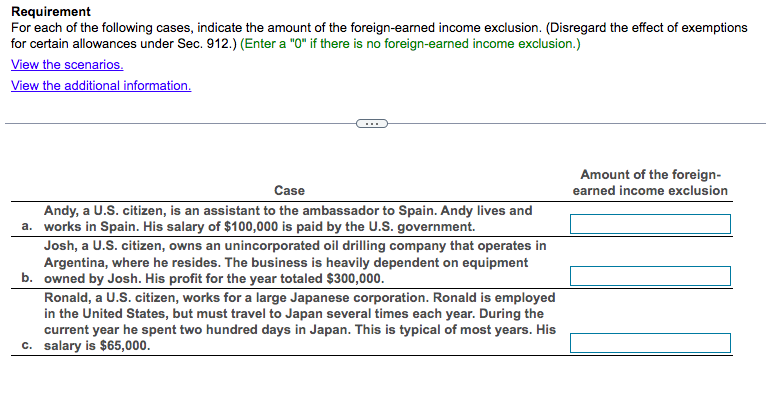

The foreign made revenue exclusions, sometimes described as the Sec. 911 exclusions, omit tax on earnings gained from functioning abroad. The exemptions comprise 2 parts - a revenue exclusion and a housing exemption. The following Frequently asked questions talk about the advantage of the exclusions including when both partners are deportees in a general way.

Feie Calculator Things To Know Before You Buy

The revenue exemption is currently indexed for inflation. The optimal annual earnings exclusion is $130,000 for 2025. The tax benefit leaves out the revenue from tax obligation at lower tax obligation prices. Formerly, the exclusions "came off the top" minimizing income topic to tax at the top tax obligation rates. The exemptions may or might not reduce revenue used for other functions, such as individual retirement account limits, youngster credit ratings, individual exemptions, and so on.

These exemptions do not exempt the incomes from US tax however merely supply a tax reduction. Note that a bachelor functioning abroad for all of 2025 who gained about $145,000 without other earnings will have taxable revenue reduced to zero - properly the exact same solution as being "tax totally free." The exclusions are calculated each day.

If you attended service conferences or seminars in the US while living abroad, earnings for those days can not be excluded. For US tax it does not matter where you maintain your funds - you are taxable on your globally income as an US individual.